Recovery Guide How to Move Forward After a Catastrophe

This is a very difficult time for you. You feel overwhelmed and may not know where to start.

If you are on this page, you’ve taken the first of many steps towards recovery. Teaming with a public adjuster will make this process easier for you.

We will help you understand your responsibilities versus those of your insurance company. We will make you aware of different parties that could be involved. And we will assist you through every phase of the process to ensure that you effectively manage the professionals you may encounter over the next three to six months.

Next Steps

Once you have found a safe place to stay following the loss, you should:

- Contact your insurance agent or company.

- Have your insurance agent report a claim.

- Your insurance agent will go over your policy & responsibilities after your loss.

- Your insurance company will send out an adjuster to come out and assess your scope of loss.

- Attempt to mitigate further damages.

- Take pictures or videos of the entire process so that you can accurately show what happened and what you had to do.

- Safety always comes first, but you should do what you can to prevent further damage to your insured property.

- Examples include:

- Covering windows with tarps to stop rain from causing additional water damage.

- Keep all receipts related to damage mitigation.

- Hire a professional mitigation company. Ensure that the company you want to hire is IICRC certified (Institution of Inspection Cleaning and Restoration Certification). Before any work begins, get in writing that you will not pay more for mitigation than the insurance company will approve.

- We can help you manage the mitigation company you choose.

- Take pictures or videos of the entire process so that you can accurately show what happened and what you had to do.

- Contact an ALE representative.

- ALE is coverage for Additional Living Expenses such as food or the cost of staying in a hotel or an apartment that you might incur while your home is temporarily uninhabitable.

- This coverage is a standard part of most homeowners' insurance policies, but many don't realize they have it.

- It will reimburse the insured for the cost of maintaining a comparable standard of living following a covered loss that exceeds what normal expenses were before the loss. Limits are capped at a percentage of the home's insured value.

- Communicate with your ALE representative and be sure to save all receipts to document your expenses. If you are unsure of how to obtain one, we can help you find a representative.

- Hire reputable contractors.

- A professional building contractor will get you an estimate of how much it will cost to restore or rebuild your home.

- Look for someone who is licensed with an active bond or insurance in place.

- The contractor should not modify the scope of work but base the estimate on repairs related to your claim.

- Check references and visit properties of their clients.

- File a claim with your insurance company.

- Before you can settle your claim, a walk-through must happen with your insurance company.

- Be sure to have all your documentation including receipts, photographs, and videos.

- Don't feel pressured to answer any questions that make you uncomfortable during the walk-through.

The public adjusters at Jansen Adjusters International will walk you through the entire process and get you the maximum amount of recovery you deserve.

5 Questions for Yourself

After suffering the loss of your home, you will have many questions.

These may be the most important:

- Are you prepared to answer questions from your insurance adjuster regarding damages?

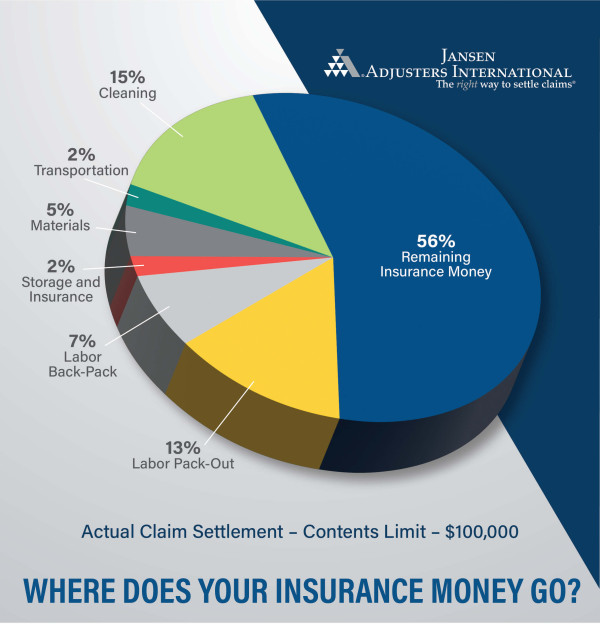

- Do you understand your insurance coverage as it relates to replacement costs versus actual cash value?

- Do you know how to navigate your additional living expenses with minimal impact on your current lifestyle?

- Do you know how to prepare a detailed inventory of your personal property?

- Are you prepared to prove your damages to the insurance company per your policy provisions?

Record the answers and then contact the Jansen/Adjusters International team to help with the next steps.

Terms You Need to Know

- Mitigation Company

- After a fire, hurricane, or tornado has damaged home, the owner must do what is necessary to prevent further damage and potential danger. This may involve hiring a mitigation company to handle the work. Contractors will remove debris, board up, clean, detoxify, and secure the damaged structure.

- When hiring a damage mitigation company, be aware of the process and the potential cost up-front. Be sure to include a warning stating that the insured will only be responsible for insurance-approved pricing and scope of repair.

- After a fire, hurricane, or tornado has damaged home, the owner must do what is necessary to prevent further damage and potential danger. This may involve hiring a mitigation company to handle the work. Contractors will remove debris, board up, clean, detoxify, and secure the damaged structure.

- Scope of Loss

- The scope of loss refers to the amount and type of damage your home incurs. It measures the quantity and quality of the materials and the current cost of those materials and the labor requirements. It may include photos, diagrams, and detailed line-item entries broken down to comply with local building codes.

- In the case of fire, the scope of loss would include everything that burned plus smoke damage, water damage from fire hoses, and environmental repercussions. Debris removal, cleaning, and odor abatement would also be added to the cost of rebuilding. Depreciation figures in, as well.

- Again, pay attention to the wording of your policy and any language appearing on payments. Do not cash something that says “Full and Final Settlement” if you are expecting more money. Consult with your insurance carrier if you have any questions, because an accidental printing can cause issues down the line.

- ALE

- ALE (Additional Living Expense) coverage helps the homeowner maintain a comparable standard of living until the home can be inhabited again. A standard part of most policies, it covers the cost above your normal expenses for things like food and lodging at a hotel or apartment while the home is being restored. Utilities, rental furniture, and additional automobile mileage due to temporarily relocating farther away from your job are also covered.

- Because home repairs can take a considerable amount of time, you should take advantage of ALE immediately. ALE will only pay up to the homeowner’s insurance policy limit.

- Restoration Contractors

- In order to return your home to its original state, you will have to hire a restoration contractor. By hiring a licensed, experienced, and professional contractor, not only time will be saved, but costs can be kept at a minimum. Be sure to verify credentials and check the background of any contractors you are considering. Ask to see certifications, vet references, and check the Better Business Bureau rating for any reviews of work or previous complaints.

- Public Adjusters

- Whether fire damage is partial or extensive, the time and stress involved can have an effect on your well-being. Public adjusters will thoroughly document the scope of loss and identify any hidden damages that may cause problems later. This will help maximize the amount you are entitled to recover from your claim. The National Association of Public Insurance Adjusters (NAPIA) and the Texas Association of Public Insurance Adjusters (TAPIA) can qualify that your public adjuster’s company is licensed and regulated in accordance with insurance codes.

He has spent over 30 years helping policyholders obtain a fair and full settlement of property damage insurance claims for all types of properties, including homes, multi-family apartment units, condominiums, hotels, etc. David works to expedite and maximize their financial recovery, allowing his clients to run their businesses and care for their families.