Why Skyrocketing Construction Costs are the New Catastrophe in Texas

Winter storm Uri caused an estimated $10-$20 billion in property damage in Texas. Homeowners, Commercial Real Estate (CRE) investors, and multi-family apartment complex owners may discover their property insurance coverage limits will not be enough to rebuild — even if their policy includes extended replacement cost coverage.

Property owners are asking: "How can that be? The answer lies in skyrocketing construction costs, including lumber, steel, fuel, and labor.

Construction costs normally increase every year due to inflation. Extended replacement cost coverage normally helps to protect property owners and the extra costs brought about by inflation; adding a cushion for policyholders when they file a property damage claim. On most property policies, the extended replacement cost coverage provides an additional ten percent of the insurance limit purchased for the primary structure (Coverage A).

So, for an apartment building that is insured for $300,000, the extended replacement cost coverage provides another $30,000 for repairs/replacement after a loss. Historically, this was enough, or nearly enough, to compensate for normal labor and material cost increases.

Think back to 2019. Remember how the US economy was bustling — so perfect it was called a "Goldilocks" economy. Unemployment was low and consumer confidence was high. Mortgage interest rates remained low.

But 2020 was a very different kind of year.

The demand for construction materials began to escalate rapidly. Then, trade tariffs took their toll — lumber and steel were both high but still affordable. In March of 2020 the COVID-19 pandemic led to a complete shutdown of logging and lumber milling, transport stalled, and supply chains choked. Numerous political upheavals of 2020 put more strain on the limited supply of building materials. Although construction workers began to return to the workplace, there were additional costs for employers like Personal Protective Equipment (PPE), COVID testing and handwashing stations.

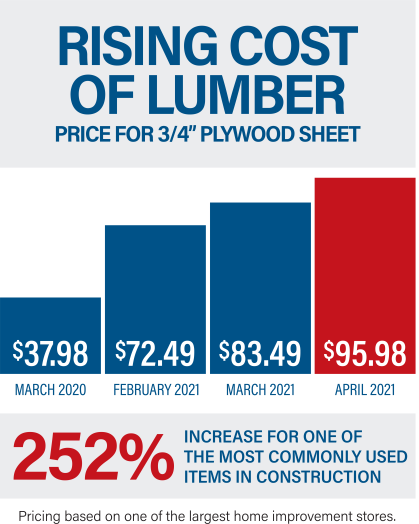

And finally, here comes Uri, which shuts down many Texas refineries resulting in diesel and gasoline prices jumping. Construction contractors see lumber prices increase 250% higher than they had seen in 2019.

So, an apartment building insured for $300,000 — even with the extra $30,000 extended replacement cost coverage — cannot be replaced with the proceeds of the insurance claim alone. That structure might cost $750,000 to rebuild in 2021.

Even if there is just a partial loss some property owners are facing a different challenge with their insurance claims: they are not receiving the adequate claim settlements that they need to cover the extraordinary cost of the repairs. Besides making sure that you have enough insurance coverage, the team at Jansen/Adjusters International believes policyholders should also understand how their property claims should be calculated if they sustain a loss.

How Property Claims are Tallied: Xactimate Claims Adjusting Software

Xactimate building estimating software is the national industry standard used by most insurers to calculate property damage losses. But it is not perfect. When a major storm like Uri hits a region, the software might not include the surge in local labor costs and materials that follow a major catastrophe.

Xactimate building estimating software is the national industry standard used by most insurers to calculate property damage losses. But it is not perfect. When a major storm like Uri hits a region, the software might not include the surge in local labor costs and materials that follow a major catastrophe.

While Xactimate strives to keep up with regular price changes related to material prices, tariffs, and wage increases, it often lags in hard-hit regions like Coastal Texas. So even the most well-intentioned company claims adjuster is working with inaccurate numbers.

That is why professional estimates and public adjusters must come into play. To recover fully, you need to ensure that your property insurance policy's limits are adequate should a disaster occur. When catastrophes happen, hire a licensed public adjuster to work on your behalf to prepare and negotiate your claim. We understand the skyrocketing costs of construction, and we will help you get the insurance claim payment you deserve.