Reading Resources for Hurricane Ida

Hurricane Ida made landfall on August 29th as a frightening Category 4 storm.

Roofs were torn from homes and businesses, flooding the region, making it impossible for further evacuation. More than 900,000 homes and businesses were without power. The storm has claimed numerous lives. Unfortunately, the state of Louisiana is still recovering from last year's back-to-back hurricanes, Laura and Delta.

As resources for disaster recovery become strained, we thought it may be appropriate to share a few reading resources to stay informed as many wait for the opportunity to get back to normal.

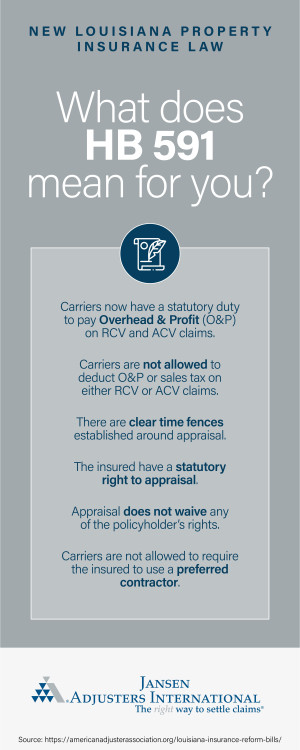

Louisiana Passes 2021 Insurance Reform Bills to Help Policyholders

The American Adjuster Association announces the passing of HB591 and HB547 that will hold insurance carriers accountable for bad faith actions, in order to ensure fair claims handling. This is a huge win for Louisiana policyholders who are still recovering from last year’s hurricane damage.

- Claims adjusters can now be held liable for “bad faith” behavior.

- Insurance carriers will no longer be able to use Managed Repair Programs (MRPS)

- Carriers will have to provide an explanation of depreciation if it is deducted from the claim settlement.

- The contractor's overhead and profit are now covered on claims when their services are reasonably foreseeable.

Check out their article to read more highlights.

Ida’s Insurance Impact Likely to Be Boosted By Pandemic Pricing

Business Insurance, a key publication for risk managers, insurers, brokers, and other providers of insurance products and services, discusses how insurers are bracing for impact as the $15-30 billion in claims from Hurricane Ida increases in cost due to pandemic pricing. Insurers will be extra diligent with inspections and getting eyes on the ground.

While residential flooding will largely be covered by the National Flood Insurance Program, commercial policies are expected to generate contingent claims from businesses unable to get supplies or sell their product due to storm impact. That is if they have coverage in place which covers the economic losses resulting from the loss of the delivery to and from the dependent properties, which also sustained direct property damage, from the event.

How to File a Complaint with the Louisiana Department of Insurance

The Property Insurance Coverage Law blog discusses how on average, there are 3600 complaints every year from insured individuals who are dissatisfied with their insurance provider. This article provides step-by-step directions on how to file your grievances and what to expect.

Merlin Law Group's blog is often used by many property loss professionals because it provides useful insights to the consumer.

Flooding: Everyone is Exposed, Few are Insured, But New Options Entice

Adjusting Today, a publication provided by Adjusters International details alternative insurance options to the National Flood Insurance Program. This reading is ideal for property owners facing a more widespread risk of flooding.

Your best course of action is to keep your families safe and your commercial interests afloat during this challenging time. Currently, we are active in the region where Hurricane Ida hit helping our past and current clients sort out their insurance needs.