Wind or Water Damage: What Happens When the Gusts are Gone and the Waters Recede?

Damage to your property from wind and water can cause tremendous emotional and financial stress. It can also be hard to know what to do next – where do you start with filing a claim or salvaging items from your home?

At Jansen/Adjusters International, we have handled wind and water claims for over 40 years, and we’re here to help walk you through some of the most common questions and concerns property owners encounter following a wind or water loss.

What will my insurance company do after my property suffers wind or water damage?

The insurance claims process begins as soon as you report your loss to the insurance company, which should happen as soon as possible after water or wind damage occurs. Once your insurance company has been notified, they will assign an adjuster to handle the claim on their behalf. Once on site, the insurance adjuster or a representative will likely create a detailed estimate of the damage. Your insurance company may also send a third-party company to document all of the non-salvable items.

What should I do after wind damage or water damage?

Here are a few tips for property owners following a wind loss or water damage:

- Take photos and videos and save them to the cloud to document as much of the damage as possible. Detailed photos can go a long way to help prove your claim.

- To prevent looting, remove items of value, such as money, jewelry, firearms, and family heirlooms from the structure once it has been deemed safe to enter.

- Mitigate damage as soon as possible by putting a tarp over a damaged roof or removing wet items from your house to avoid further damage and the spread of mold. Your insurance will only want to pay for the removal of materials that are wet and damaged. Remove wet, soft, or mildewed drywall and set it all outside until the adjuster can inspect it.

- Remember to save your receipts for immediate purchases, including dining, pet boarding, and housing after the loss. If you spend money, be sure to get a receipt. These purchases might fall under your additional living expense (ALE) coverage, and you could be reimbursed.

- Keep in mind that your flood insurance policy will not cover temporary housing and other additional living expenses. However, ALE coverage can cover additional housing and living expenses due to wind damage. Also note that the insurance company might pay for you to stay in a hotel until you find temporary housing.

- Be cautious when looking for a remediation or restoration general contractor. Try to find one with experience in dealing with wind and water losses and insurance claims, but keep in mind that if a storm hits the area, many out-of-town contractors will be looking to capitalize on the disaster area. Jansen/Adjusters International or your insurance company can make recommendations but remember that the final decision on repair contractors you hire is yours.

What should I avoid doing after wind damage or water damage?

It may be tempting to clean up after a disaster, but you should avoid cleaning or throwing away anything until the insurance adjuster releases the loss from further investigation. Other than valuables and undamaged items, non-salvable items need to remain in the house, preferably in the room they were in at the time of the loss. Be cautious of remediation companies who try to convince you to pack out and clean items that have been affected. You can discuss this with Jansen/Adjusters International to determine what is best for your needs based on your insurance policy coverage.

Additionally, avoid signing a direct pay authorization (DPA) with a contractor. A DPA allows the insurance company to pay the contractor directly, meaning you have no control over your settlement money.

How can a public adjuster help me with my wind or water loss claim?

After your property has been damaged by wind and/or water, expert public adjusters can guide you through the process of attaining a fair settlement from beginning to end.

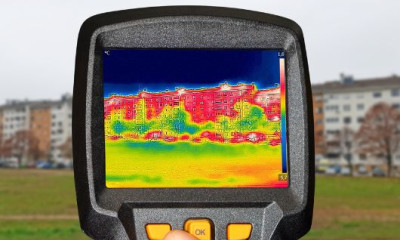

To ensure the claim is properly documented, a public adjuster will take photographs of your property and its contents, while developing a detailed itemized inventory of all of your personal property and a detailed estimate of the damages to your house. This estimate will be sent to the insurance adjuster as our preliminary scope of damage, which will be compared to the estimate made by the insurance company’s adjuster.

Because a public adjuster works for the policyholder – never the insurer – a public adjuster has the motivation to find additional hidden damages such as water damage to insulation or mold growth. The insurance company’s adjuster may not take the time to uncover these hidden damages. Still, you should know that, under your insurance policy, you may be entitled to compensation for all of the damage to your home.

The Jansen contents team that is sent to your property will be sure to inventory all damaged items – including non-salvageable pieces – and price them accordingly. This is a long and tedious process that can often feel overwhelming for homeowners. To relieve as much stress as possible, our team will complete the inventory list and provide it for your review. After you provide us with any additional information, including the ages of more expensive items, we will submit the list to the insurance company’s adjuster to document your claim.

You can rely on your Jansen/Adjusters International team to guide you through the decision-making process throughout your property insurance claim. Our adjusters are licensed by the State of Texas to protect your insurable interests after a loss. Jansen/Adjusters International is committed to helping you through this difficult time and getting you a proper settlement.